how to calculate pre tax benefits

Its important that. Cannot load calculator at this time.

Are Payroll Deductions For Health Insurance Pre Tax Details More

Please note that any principal amount is not eligible for tax deduction.

. Synergy benefits can come from four potential sources. Typically with pre-tax deductions the employee pays less in federal income and FICA Social Security and Medicare taxes. Employee benefits can be seen as additional wages subject to taxes.

Calculate the employees gross wages. Identify applicable payroll taxes. Since your insurance plan isnt taxable your employer does not include your premiums on your W-2.

Subtract the value of your debt service from your NOI. For instance on a Pre-EMI of Rs5 lakhs Rs 1 lakh will be depicted as tax deduction for the next 5 years. Actual results may vary.

Identify applicable payroll taxes. And transportation benefits such as parking and transit fees. In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and employment taxes are applied.

Lastly click on Calculate. Refer to the employees Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax. Regular or Senior citizen Then enter your gross annual income and the principal and interest paid on the home loan for the year in the respective fields.

Some states also allow a section 125 plan to reduce the amount an employee owes in state income taxes. Calculate the taxable wage base for each payroll tax. Pretax deductions include qualified 401k contributions.

The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period. Calculate how much more money you could take home when you use a pre-tax benefit. Say you have an employee with a pre-tax deduction.

Profilename Drag Slider to Estimated. First subtract the 50 pre-tax withholding from the employees gross pay 1000. Calculate how much more money you could take home when you use a pre-tax benefit.

As a result this lowers the total income amount that is taxed which reduces the income taxes the. The results provided are an estimate based on the information provided in the input fields. Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement plans and other voluntary benefits.

Because section 125 plans are pre-tax they also come out before federal unemployment tax FUTA reducing your employer FUTA liability. Medical vision disability vision and life insurance. To determine your total gross wages earned for the year factor in.

23000 is 6200 more than 16800. Subtract pretax benefits from gross wages to arrive at taxable wages for federal income tax purposes. On completion of the construction the total pre-EMI interest paid in the subsequent years is deductible in 5 equal instalments.

StateLocal Tax Rate Percentage to estimate your combined state and local income tax rate. Your annual W-2 includes your taxable wages for the year. Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement plans and other voluntary benefits.

We take your gross pay minus 4050 per allowance times this percentage to calculate your estimated state and local taxes. First choose the applicable customer type. If you contribute a portion of your salary on a dollar.

Or here is another way we can calculate synergies in MA. For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800. Fill in each box with the total expenses you have had or will have in a given plan.

NPV net present value of a newly created company. To know your benefits via a home loan tax saving calculator simply follow these 3 steps. Social Security tax is also called Federal Insurance Contributions Act tax because the FICA mandates its collection.

However with the right plans employer-paid insurance premiums can be delivered to the employee pretax. Federal Income Tax Rate Choose from the dropdown list. As a rule of thumb synergy is a business combination where 22 5.

A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes. Some facts about Saras pretax deductions. When an employee pays for benefits such as health insurance with before-tax payments the deduction is taken off their gross income before taxes.

The savings from pre-tax deductions depends entirely on how many pre-tax benefits are elected and the amount an employee decides to contribute to them. Actual Cost Of Pre-Tax Contributions. Please note this calculator.

Note that the tax calculations are based on your overall tax rate. A pre-tax commuter benefit is when employees can have the monthly cost of their commute deducted from pay before taxes which means more take-home pay and for employers saving on reduced payroll taxes. Synergy NPV Net Present Value P premium where.

Pretax deductions are employer-sponsored benefits that meet the regulations of. Pretax insurance benefits offered under a Section 125 cafeteria plan arent taxable so theyre taken out of your gross wages before taxes are deducted. Pre-EMI is only the interest paid during the period.

This calculator and the estimates provided should not be used as the sole basis for making financial decisions. Identify potential pretax deductions. The employees taxable income is 950 for the pay period.

This calculator will give you an estimate of the money you save by paying for eligible expenses through one or more of the tax-free benefits provided by your employer. When an employee enrolls in a pre-tax commuter benefits program they will provide the amount of their monthly. This entry is optional.

How Employees Save in a Pre-tax Program. Contribution Rate Percentage of your salary youre currently contributing to your plan account. Follow these steps the next time you do payroll.

Financial Finesse provides information and education on a. 1000 50 950. Withhold 765 of adjusted gross pay for Medicare tax and Social Security tax up to the wage limit.

Net Operating Profit After Tax Nopat Formula And Excel Calculator

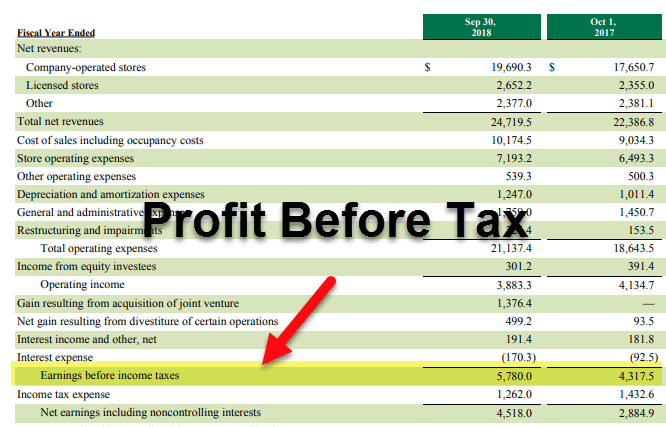

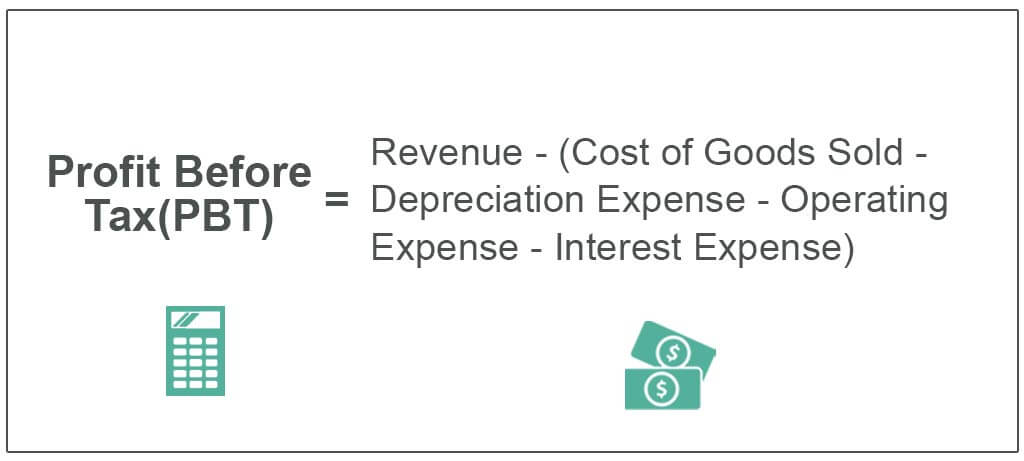

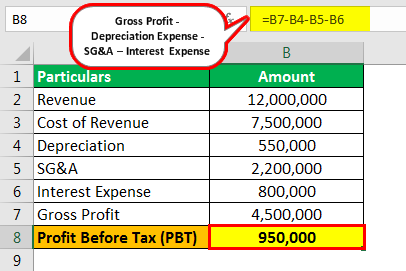

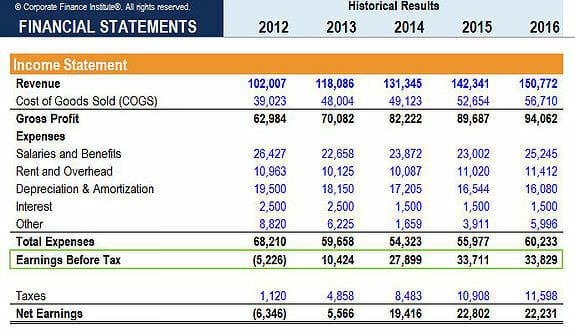

Profit Before Tax Formula Examples How To Calculate Pbt

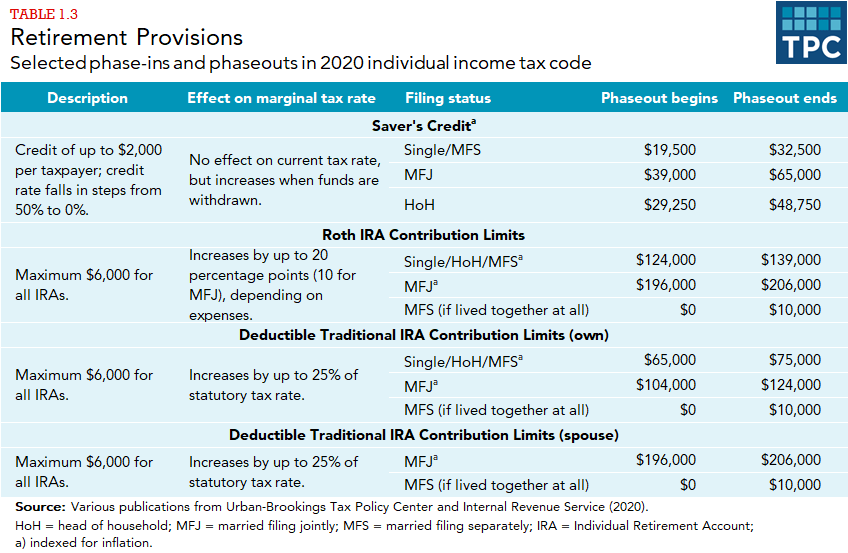

What Are Marriage Penalties And Bonuses Tax Policy Center

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Profit Before Tax Formula Examples How To Calculate Pbt

Profit Before Tax Formula Examples How To Calculate Pbt

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

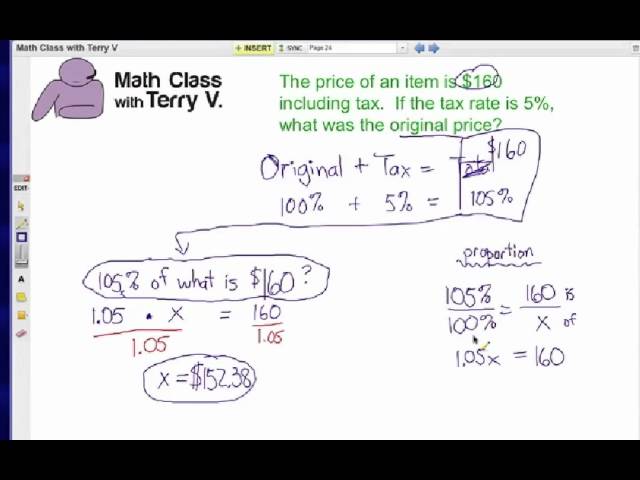

How To Find Original Price Tax 1 Youtube

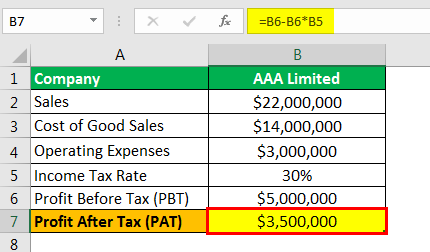

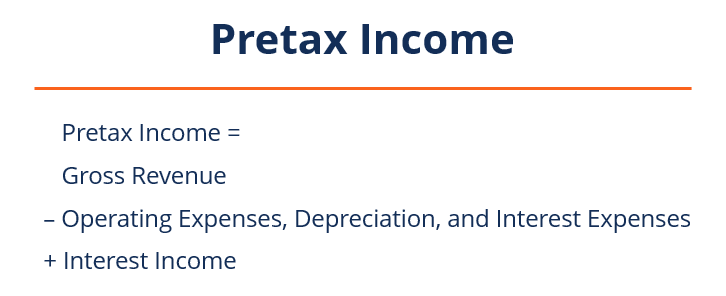

Profit Before Tax Pbt Overview How To Calculate Example

Profit Before Tax Formula Examples How To Calculate Pbt

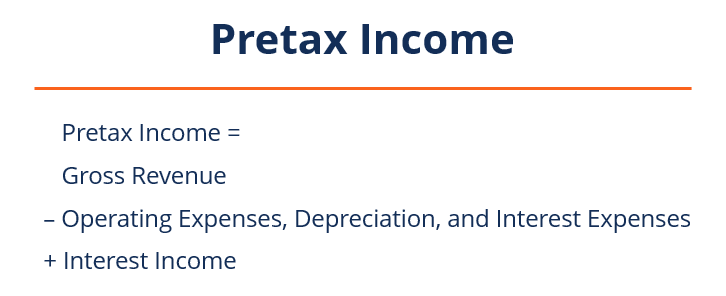

Pretax Income Definition Formula And Example Significance

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Earnings Before Tax Ebt What This Accounting Figure Really Means

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)