sales tax on clothing in buffalo ny

New York has state sales tax of 4 and allows local governments to collect a. The New York sales tax rate is currently.

With local taxes the total sales tax rate is between 5600 and 11200.

. Buffalo is located within Erie County New York. The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use Tax of 8875 percent. New Yorks basic sales tax is 7 percent.

The state sales tax rate in Arizona is 5600. The sales tax rate does not vary based on zip code. Now through Sunday the state is lifting its.

The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use Tax of 8875 percent. The minimum combined 2022 sales tax rate for Buffalo New York is. By Mark Scott Buffalo NY A sales tax-free week on clothing purchases in New York began Monday.

Burnt Hills NY Sales Tax Rate. The December 2020 total local sales tax rate was also 8750. This is the total of state county and city sales tax rates.

There is also a transit tax that some counties include in their sales tax. Burke NY Sales Tax Rate. Burt NY Sales Tax Rate.

Arizona AZ Sales Tax Rates by City. Clothing and footwear sold for less than 110 per item or pair and items used to make or repair this clothing are exempt from the New York State 4 sales and use taxes. If youre clothing total is under 110 I believe the 4 NYS tax is waived.

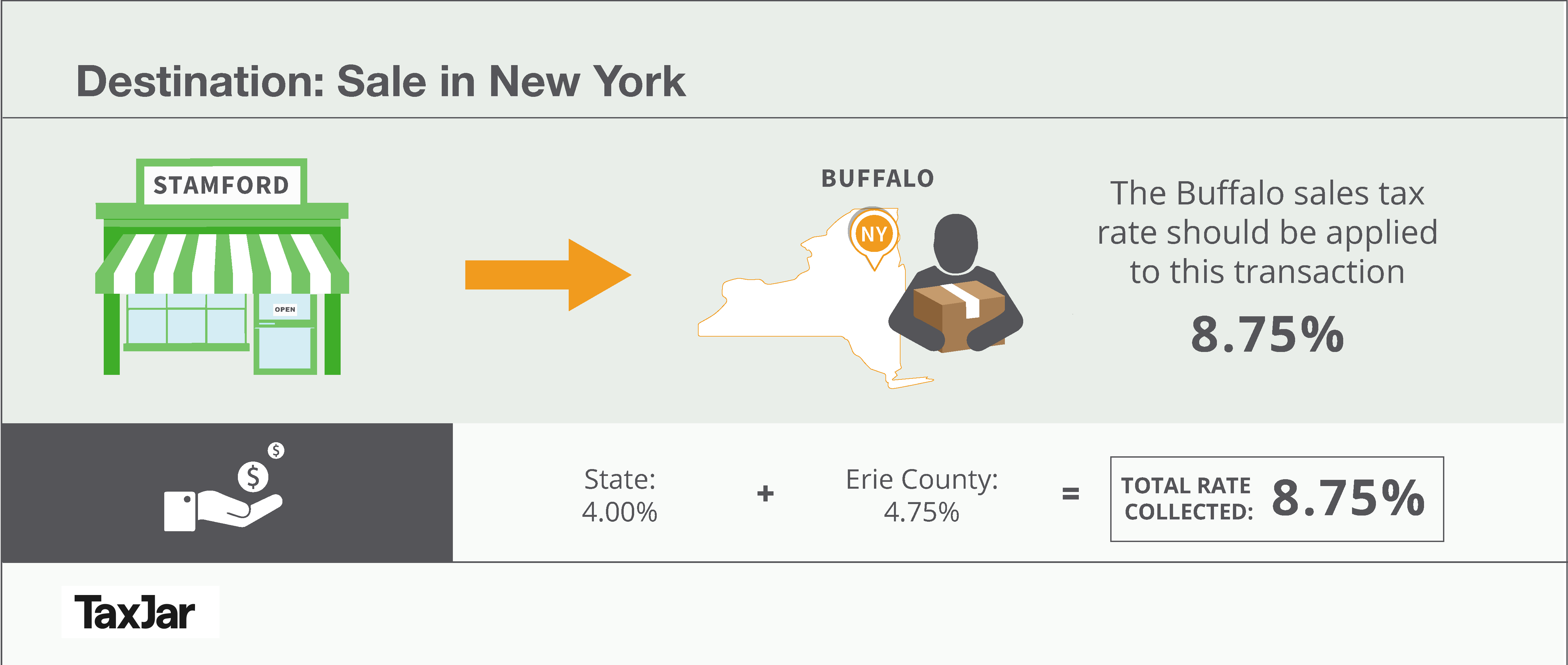

You can print a 875 sales tax table here. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax. The exemption does not apply to local sales and use taxes unless the county or city imposing the taxes elects to provide the exemption.

Answer 1 of 6. Did South Dakota v. You can get the business name registration here.

Buffalo NY Sales Tax Rate Buffalo NY Sales Tax Rate The current total local sales tax rate in Buffalo NY is 8750. Burlingham NY Sales Tax Rate. Clothing footwear and items used to make or repair exempt clothing sold for less than 110 per item or pair are exempt from the New York State 4 sales tax the local tax in localities that provide the exemption and the ⅜ Metropolitan Commuter Transportation District MCTD tax within exempt localities in the MCTD.

For tax rates in other cities see New York sales taxes by city and county. The current total local sales tax rate in Buffalo NY is 8750. There is no applicable city tax or special tax.

The state keeps the 4-percent portion of the sales tax on qualifying purchases. The County sales tax rate is. Buchanan NY Sales Tax Rate.

Bullville NY Sales Tax Rate. So if you sell a Clothing Store item at 40 you will need to charge 425 because you will need to charge and collect sales tax. On childrens clothing adult clothing food etc.

On clothes footwear and college textbooks New York exempts the buyer from the states 4 sales tax on the first 110 of your purchase but it. Any clothing items or pairs of footwear which costs more than 110 dollars is considered to be taxable. In the state of New York the clothing exemption is limited specifically to footwear and clothing which costs no more than 110 dollars for each item or pair.

The Buffalo sales tax rate is. Burlington Flats NY Sales Tax Rate. Within Buffalo there are around 43 zip codes with the most populous zip code being 14221.

Back to New York Sales Tax Handbook Top. Buffalo NY Sales Tax Rate. See reviews photos directions phone numbers and more for Sales Tax Office locations in Buffalo NY.

The Buffalo sales tax rate is 0. The average cumulative sales tax rate in Buffalo New York is 875. What is the sales tax for products in Buffalo.

Burdett NY Sales Tax Rate. Common goods that are exempt from sales tax include groceries and clothing or footwear that cost less than 110. Beauty barbering hair restoring manicures pedicures electrolysis massage tanning tattooing and other similar services.

This includes the rates on the state county city and special levels. So you would end up with just the 475 county tax. Sales and Use Tax Rates on Clothing and Footwear Effective March 1 2022 Clothing footwear and items used to make or repair exempt clothing sold for less than 110 per item or pair are exempt from the New York State 4 sales tax the local tax in those localities that provide the exemption and the ⅜ Metropolitan Commuter.

The result is that you can expect to pay between 7 and 8875 sales tax in New York. Counties keep the other 3 percent charged. Buffalo NY Sales Tax Rate.

New York City has the states highest tax rates at 8875. Beauty barbering hair restoring manicures pedicures electrolysis massage tanning tattooing and other similar services.

Thanksgiving Funny Turkey Football Team Buffalo Bill T Shirt

Buffalo East Side Travel Guide At Wikivoyage

Buffalo Sabres Nhl Banana Slug Ryan Miller 30 Jersey Reebok Blue Strapback Hat In 2022 Reebok Strapback Hats Buffalo Sabres

Mix No 6 Women S Buffalo Plaid Triangle Blanket Scarf Casual Outfits For Moms Women S Buffalo Plaid Business Casual Dresses

How To Charge Your Customers The Correct Sales Tax Rates

80s Bracelets Ad By Flynn1978 On Deviantart

Ben Garelick Buffalo Ny Cufflinks 10k Yellow Gold

Swt Filtered Crewneck Beroemde Meisjes Meisjes Beroemdheden

Vintage Irv Monte Navajo White Buffalo Turquoise Beaded Native American Design Ring 925 Sterling Silver Size 12 Rg 3918j

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Get To Know Us Red Wing Chevrolet Buick

Photograph Carte De Visite Cdv Collectible Photographs For Sale Ebay

American Native Swift Horse And Family Postcard Pc811 Ebay Postcard Native American Chief Vintage Postcard

How To Charge Your Customers The Correct Sales Tax Rates

Confirmed Order Supreme Decline Hooded Sweatshirt Hooded Sweatshirts Sweatshirts Supreme Shirt